Square vs PayPal for WordPress Payments: How to Choose

Are you trying to choose between Square vs PayPal as your payment processing solution?

Whether you want to accept online payments or in-person payments (or both!), both Square and PayPal can get the job. Both also work well with Gravity Forms and WordPress, though you can use them in other ways, too.

Overall, both Square and PayPal can be excellent options, which is why we’re not going to declare a single winner in this post.

Instead, this post will focus on highlighting the similarities and differences between PayPal vs Square so that you can choose the one that makes the most sense for your unique situation.

Let’s get into it!

Quick Introductions to Square and PayPal

Let’s kick things off with some general introductions to these services, before getting into the more detailed comparison.

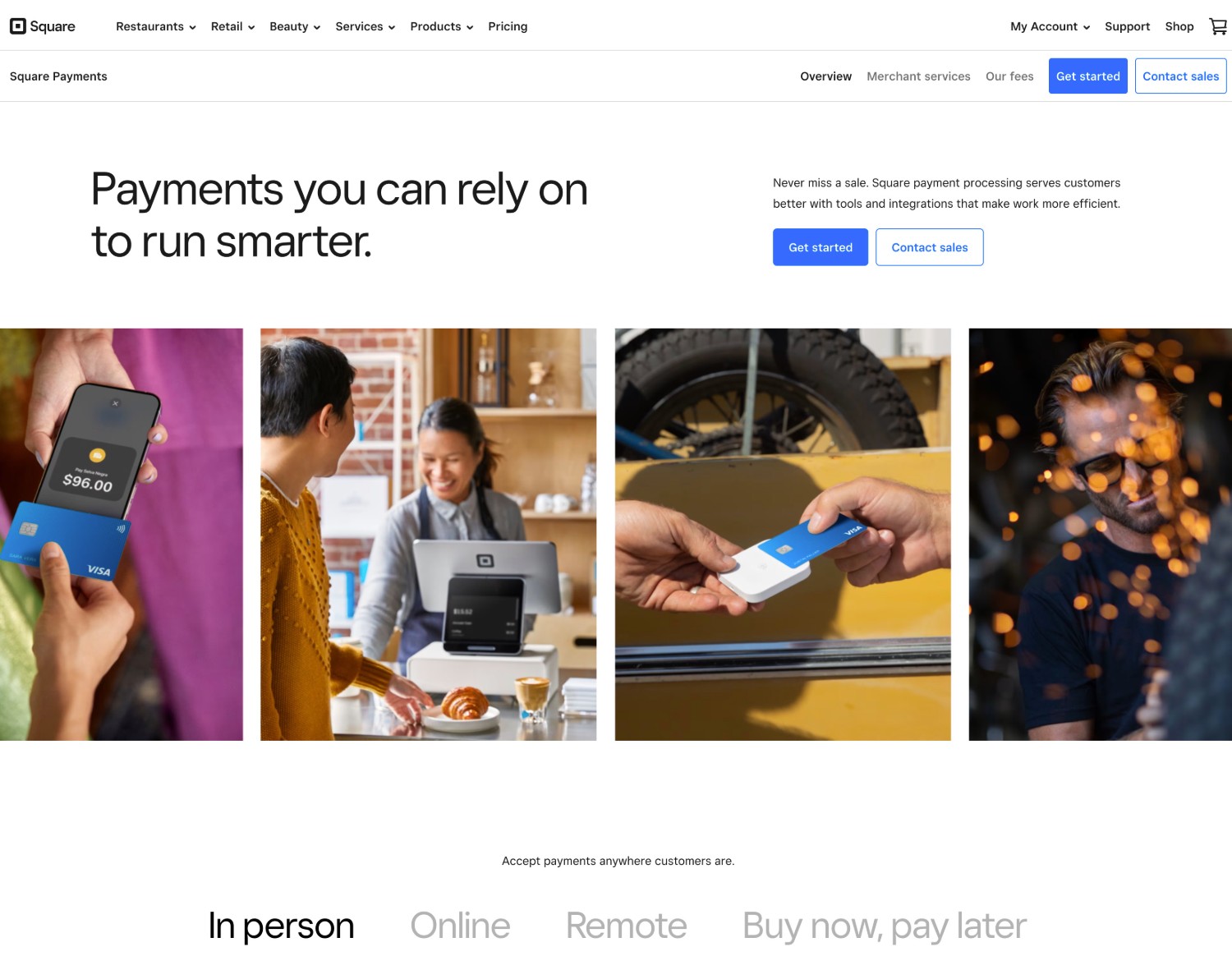

Square

Square was founded back in 2009. At the time of its launch, its standout feature was a mobile card reader that made it easy for merchants to accept in-person payments using their smartphones or tablets.

Since then, Square has grown its offerings to also support online payments, which can make it a great option if you want one tool for both online and offline payments.

In addition to its physical hardware and point-of-sale systems, Square also offers a bunch of other tools for small businesses, including an online store builder, invoicing, appointment/booking management, and more.

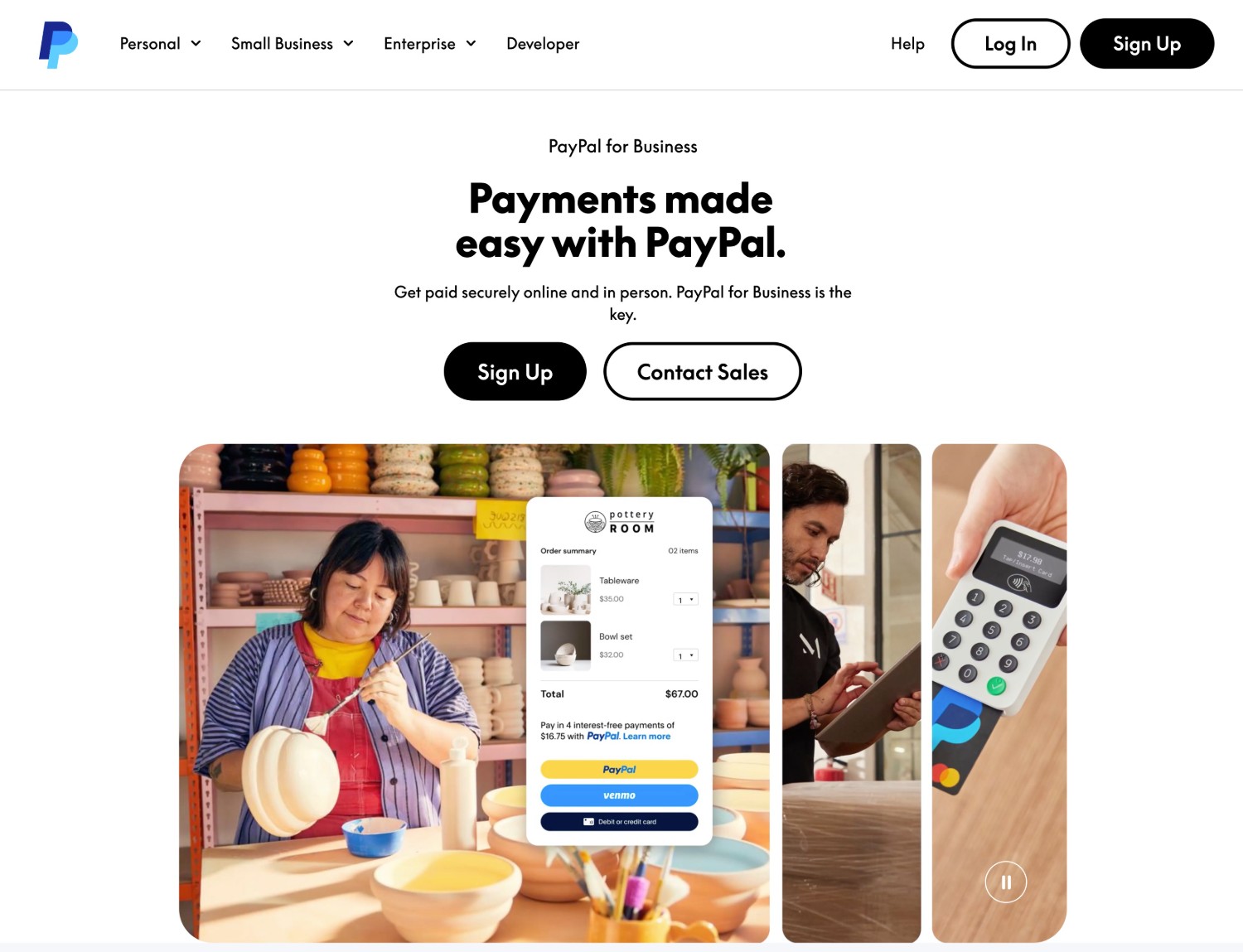

PayPal

PayPal was launched in 1998, acquired by eBay in 2002, and then spun off as a standalone company in 2015. It’s best known for its digital wallet service, which allows customers to pay using their PayPal accounts.

Customers can use cards they’ve added to PayPal or pay using the actual balance of their PayPal account. However, you can also use PayPal to accept credit/debit cards directly, even if your customer doesn’t have a PayPal account.

Beyond that, PayPal also supports a number of other payment methods that you can offer, including support for Venmo and PayPal Pay Later.

In 2018, PayPal also acquired Zettle, which helped it offer more robust tools for in-person payments, including physical hardware for processing card payments.

Notable Features

Now, let’s get into some of the main features that you can access with Square and PayPal.

Square

- Online payments – You can accept online payments via credit and debit cards, including Visa, MasterCard, American Express, Discover, JCB and Union Pay.

- Physical hardware for in-person payments – Square offers portable hardware that works with your existing smartphone or tablet, as well as full-service point-of-sale systems.

- Subscriptions – You can create automatic recurring subscriptions on a customizable billing cycle.

- Fraud protection tools – Square has its own built-in protections, but you can also use Square Risk Manager to create your own fraud protection rules.

- Reporting tools – In addition to viewing individual transactions, you can also see more high-level reports about your cash flow and payments.

- Gravity Forms Square Add-On for WordPress – You can easily accept Square payments on WordPress with the Gravity Forms Square Add-On.

As we mentioned earlier, Square also offers a number of small business tools in addition to its solutions for online and in-person payment processing:

- Invoicing – Square offers a flexible invoicing tool, including estimates, payment requests, and more.

- Loyalty programs – You can use Square to implement a loyalty program for your business.

- Gift cards – You can also offer physical or digital gift cards for your business.

- Appointment/scheduling management – Square offers a full-service appointment management tool, which can handle scheduling, payments, and more.

To see everything that Square offers, check out Square’s website here.

PayPal

- Online payments – You can accept online payments via credit and debit cards, PayPal balance, Venmo, as well as a number of smaller local payment methods (e.g. EPS and iDEAL in Europe).

- Pay with PayPal account – If you enable PayPal Checkout, customers can pay using their PayPal accounts rather than entering payment details directly. This can boost trust with customers who might be wary about typing in their card details on your website.

- Standalone payment processing – In addition to using the PayPal Checkout, you can also just collect credit/debit card details directly, which means that customers don’t need to have a PayPal account.

- Subscriptions – You can set up subscriptions that customers can manage from their PayPal accounts.

- Fraud protection tools – You can create your own customizable rules using PayPal’s Fraud Protection tool.

- Reports – PayPal offers a number of different reports to help you manage your business’s payments.

- Buy Now, Pay Later – PayPal Pay Later offers an easy solution to implement BNPL on your site.

- Gravity Forms PayPal Add-On for WordPress – You can easily create WordPress PayPal payment forms using the PayPal Checkout Add-On from the Gravity Forms team.

PayPal also offers tons of other services for small businesses and enterprise organizations. To learn more, check out the pages for PayPal for Business and PayPal for Enterprises.

Pricing, Rates, and Notable Fees

Doing a full price comparison is a little tricky because there are a lot of variables that might affect the payment processing rates you pay, such as the type of transaction (online vs in-person), the currency, the type of card/payment method, etc.

However, we will compare the base rates to give you an idea of how they stack up, along with any other notable pricing details and fees.

Here’s a quick comparison for accepting card payments in the USA to start you off:

|

Square |

PayPal |

|

|

Online card payments |

2.9% + $0.30 per transaction |

2.99% + $0.49 per transaction |

|

In-person card payments |

2.6% + $0.15 per transaction |

2.29% + $0.09 per transaction |

Note: Prices listed here are correct at the time of writing. We encourage you to check these rates for yourself as they may have changed. Below, we’ve added direct links to Square and PayPal so that you can view their official pricing pages.

Square

Square charges the following rates for payments in the USA:

- Online card payments – 2.9% + $0.30 per transaction

- In person card payments – 2.6% + $0.15 per transaction

- Manual card entry card payments (e.g. you manually keying in a person’s credit card) – 3.5% + $0.15

- ACH payments – 1%

- Square Payment Links – 3.3% + $0.30 per transaction

You can browse this page for more details on Square’s fees, or these pages for details on Square’s pricing for some other countries:

Square Chargeback Fees

One notable detail about Square’s fees is that Square does not have a non-refundable chargeback/dispute fee like a lot of other payment processors. For comparison, a lot of other payment processors will charge ~$15 per disputed payment, regardless of the outcome.

Square Monthly Account Fees

Square does not charge any monthly account fee for payments.

However, Square does offer special tools for restaurants, retailers, and appointment-based businesses. If you want to access these extra tools (such as booking management for appointment-based businesses), those plans start at $29 per month.

PayPal

PayPal charges the following rates for transactions made in the USA:

- Online card payments – 2.99% + $0.49 per transaction

- PayPal checkout – 3.49% + $0.49 per transaction

- PayPal Guest checkout – 3.49% + $0.49 per transaction

- Pay with Venmo – 3.49% + $0.49 per transaction

- Alternative Payment Method (e.g. Apple Pay) – 2.89% + $0.29 per transaction

- In-person payments (via Zettle POS) – 2.29% + $0.09 per transaction

- Manual card entry card payments – 3.49% + $0.09

You can browse this page for more details on PayPal’s USA fees, or these pages for details on PayPal’s fees for some other countries:

PayPal Chargeback Fees

For chargebacks, PayPal charges a non-refundable fee regardless of the outcome. This fee is $15 per disputed payment for US dollar transactions.

PayPal Monthly Account Fees

There is no monthly account fee to use PayPal.

Supported Countries and Currencies

The physical location where you want to accept payments could play another role in choosing between Square vs PayPal, so let’s take a look at the countries and currencies that each service currently supports.

In general, PayPal offers broader international acceptance, while Square focuses on a more narrow set of countries.

Square

Currently, Square supports physical payments and local currencies in the following countries:

- USA

- Canada

- UK

- Australia

- Japan

- Ireland

- France

- Spain

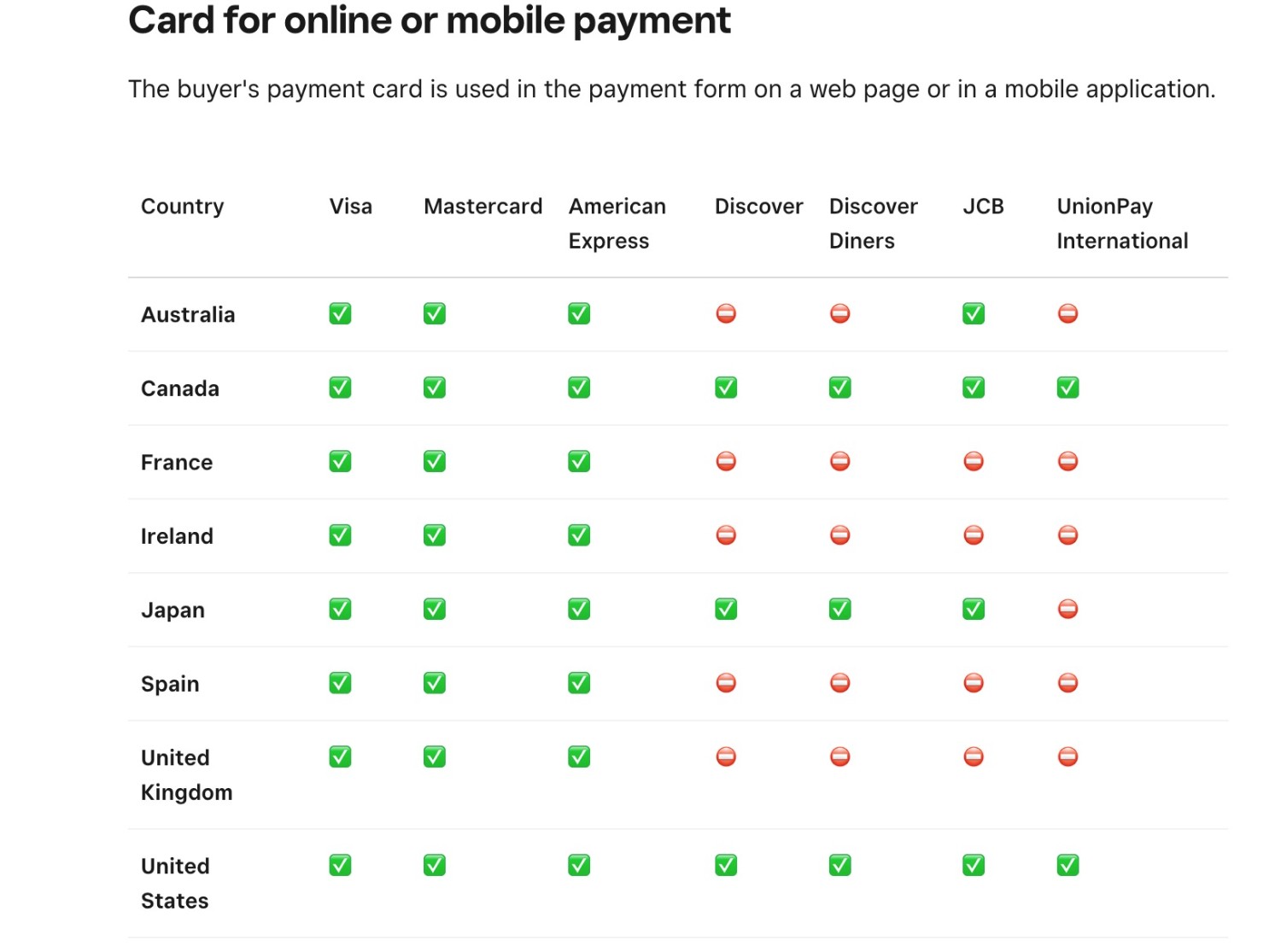

For online card payments, Square accepts all major internationally-issued cards including Visa, MasterCard, AMEX, Discover, JCB, and UnionPay.

If an international customer makes a payment, Square will charge them in your currency (the currency of the seller). The local currency charge that the customer sees will be based on the exchange rate of their card-issuing bank.

The exact types of accepted cards will depend on your region – check out this page for more details.

PayPal

PayPal is available in more than 200 different countries and supports payments in more than 25 different currencies.

These supported countries include all of the countries that Square supports, along with a bunch of other countries on all inhabitable continents. You can view the full list of countries here and a full list of the currencies here.

Gravity Forms Add-Ons

Gravity Forms offers its own official add-ons for both Square and PayPal, so you’ll be able to use either service as the payment solution for any payment forms that you create with Gravity Forms.

In this section, we’ll compare the different features of each add-on so that you understand how you’ll be able to use Square and PayPal with Gravity Forms.

It’s also important to note that both add-ons work with core Gravity Forms features like conditional logic, as well as many other integrations that Gravity Forms supports.

Square Add-On

The Gravity Forms Square Add-On is available on the Pro, Elite, and Nonprofit licenses.

Here are some of its key features…

- Credit or debit cards – Currently, the Gravity Forms Square Add-On is focused on helping you accept card payments via Square.

- One-time payments – You can accept one-time payments based on the value of any pricing field in your form.

- Subscription payments – You can set up automatic recurring subscriptions on different billing cycles. You can choose to have the subscriptions repeat indefinitely (until manually canceled) or automatically stop them after a certain number of billing cycles (great for payment plans).

- Authorize and capture – You can authorize a person’s card upon form submission but wait to capture the money until you click a button in the form entry interface.

- Refund from WordPress – You can refund payments directly from your WordPress dashboard just by clicking a button.

Gravity Forms and Square have also teamed up to offer a special promotion for new Square customers. If you’re a new customer and you sign up for Square using this link, you’ll get free processing on up to $3,000 in card transactions within the first 180 days.

Gravity Forms PayPal Checkout Add-On

The Gravity Forms PayPal Checkout Add-On is also available on the Pro, Elite, and Nonprofit licenses.

Here are some of its key features…

- Choose supported payment methods – Choose whether to offer PayPal Checkout (customers pay using their PayPal accounts), direct credit card entry (customers don’t need a PayPal account), or other payment options like Venmo.

- One-time payments – Accept one-time payments based on the value of any pricing field in your form.

- Subscription payments – Create automatic recurring subscriptions on customizable billing cycles. You can have the subscription repeat indefinitely until it’s canceled or set a maximum number of billing periods. Note – Subscriptions only work with PayPal Checkout, which means that customers will need to use their PayPal accounts to pay for subscriptions.

- Free trials and one-time setup fees – For subscriptions, you have the option to offer free trials and/or charge a one-time setup fee.

- Authorize and capture – Authorize a payment upon form submission but wait to capture the money until you click a button in the form entry dashboard.

- Refund from WordPress – Refund a person’s payment directly from your WordPress dashboard.

If you want to learn more, check out our ultimate guide to Gravity Forms and PayPal.

In-Person Payments

While we’ve focused a lot on using Square and PayPal to accept online payments, you also might have situations where you need to accept in-person payments.

Both Square and PayPal have solutions for accepting in-person payments. However, Square is probably a bit ahead in terms of the tools it offers for in-person payments.

Therefore, if in-person payments are going to play a big role in your business, that might be something that pushes you in Square’s direction.

Square

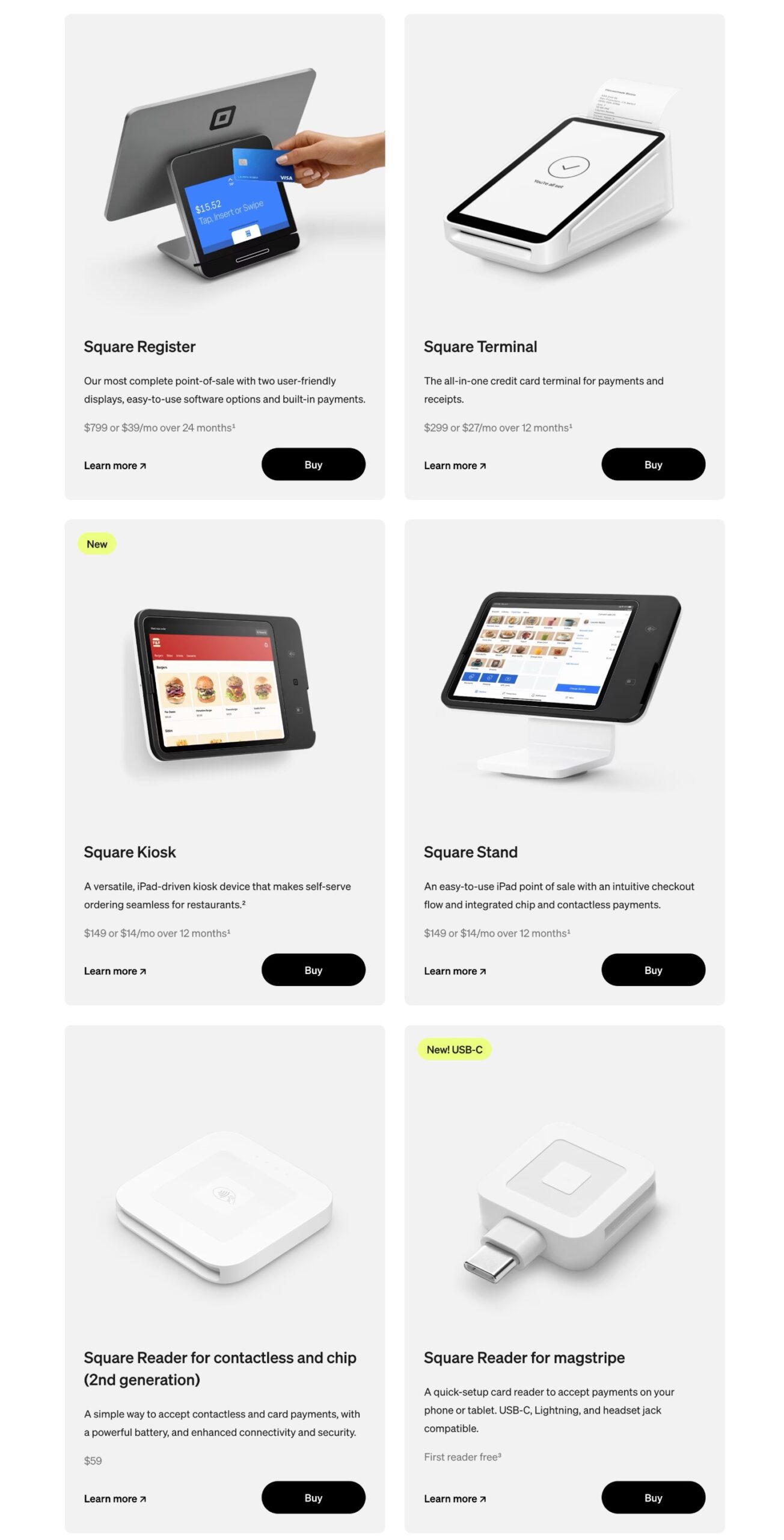

In-person solutions are one of Square’s primary focuses, so they offer a robust set of tools and hardware to help businesses accept in-person payments.

In fact, there’s a pretty good chance you’ve encountered some type of Square hardware at your favorite restaurant or cafe if you’re in one of Square’s supported markets.

Here are some of the different types of hardware that Square offers:

- Square Reader – This connects to your smartphone or tablet and lets you accept card payments.

- Square Terminal – This is an all-in-one solution that lets you accept card payments and contactless payments without needing a smartphone or tablet.

- Square Stand – Add your own iPad and you’ll instantly have a full POS solution, including accepting cards and contactless payment methods.

- Square Register – A multi-display solution that has one big screen for your customers and a smaller screen for you/your staff. It can accept all major cards and contactless payments.

Square also does a great job of promoting compatible accessories that you can use to build out your system, such as receipt printers, barcode scanners, cash drawers, scales, and more.

PayPal

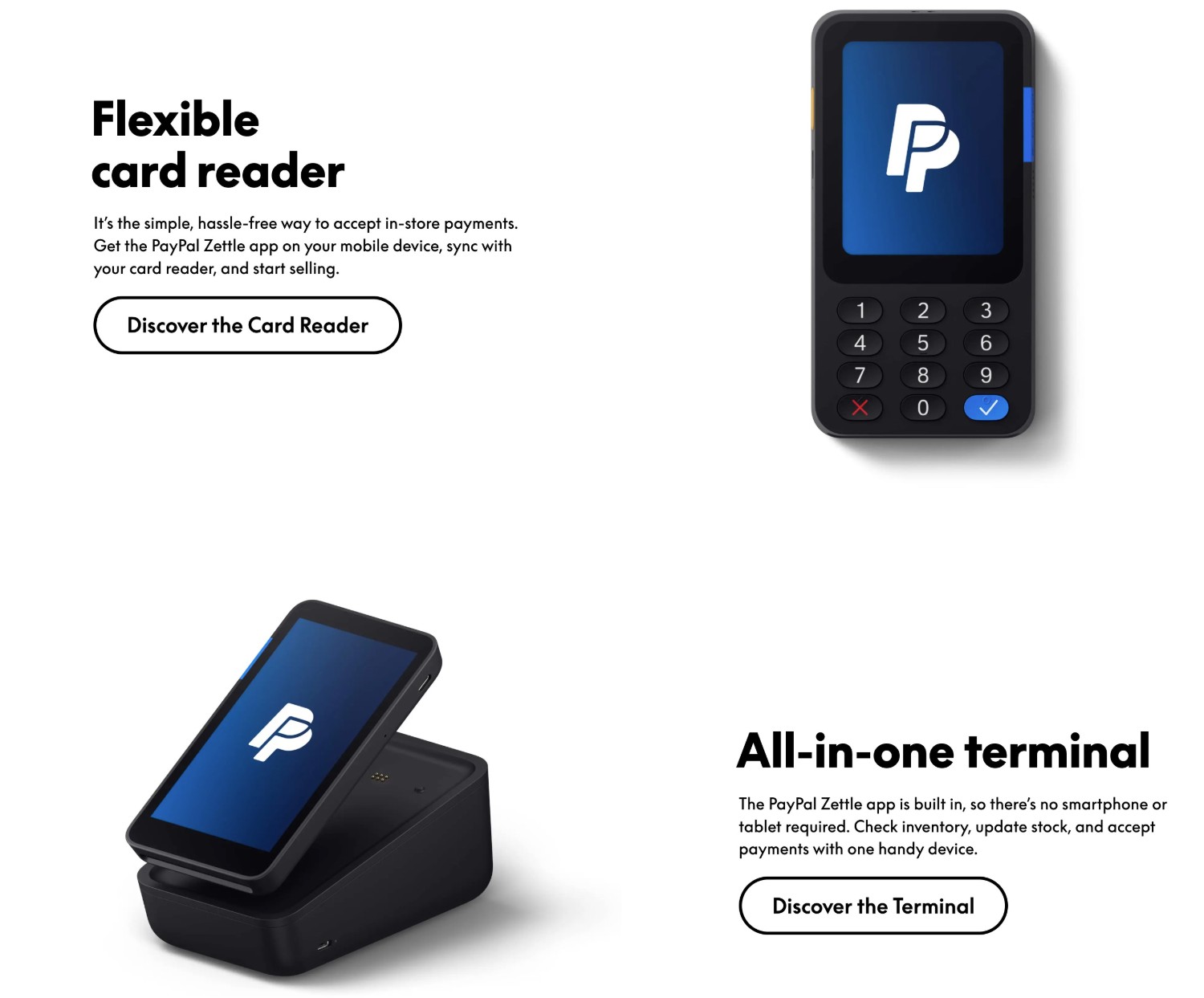

While PayPal is best known as a solution for online payments, PayPal does still offer solutions for in-person payments.

One of the simplest options is to display a QR code, which allows customers to pay via the PayPal app.

PayPal also offers physical hardware and a point-of-sale system via Zettle, which PayPal acquired in 2018.

Zettle offers a small card reader device that you can sync with your smartphone, as well as an all-in-one terminal that doesn’t require a smartphone.

Start Accepting Payments On Your WordPress Site Today

Both Square and PayPal are excellent payment processing solutions, which is why they’ve both achieved so much success in the space. As a result, you won’t make a “bad” decision and choosing between PayPal vs Square really comes down to your specific needs and preferences.

For example, PayPal could be a good option if you think your customers would value the ability to pay using their PayPal accounts, or associated services like Venmo.

On the other hand, if you also want the ability to accept in-person payments, that might be something that pushes you more toward Square, as Square really excels in that area.

Square also has some other perks, such as not charging a fee for chargebacks/disputes, which is something that most other payment processors do (including PayPal). Square’s processing rates for online card payments can also be a little bit lower than PayPal.

Either Way, Gravity Forms Is Here to Help

If you’re using Gravity Forms to create payment or donation forms on your WordPress website, Gravity Forms offers its own official add-ons for both Square and PayPal. So, regardless of which payment solution you choose, you’ll be able to integrate it into the forms that you create with Gravity Forms.

The Gravity Forms PayPal Checkout and Square Add-Ons are both available on the Gravity Forms Pro, Elite, and Nonprofit licenses. If you already own one of those licenses, you can create your first payment form today by following our guide to WordPress payments.

Not a Gravity Forms user yet? You can purchase your license here to get started accepting payments on your WordPress site!

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!