Stripe vs Square for WordPress Payments: How to Choose

Trying to choose between Stripe vs Square as your payment processor? This post is here to help!

Stripe and Square are both top-notch payment processors, so this post is not about declaring a single winner.

Instead, we’re going to try to highlight some of the ways in which they’re similar and different so you can pick the option that best matches your current situation.

We’ll also cover how these two services work with payment forms that you create with the Gravity Forms WordPress plugin, which is important if you want to accept payments on WordPress.

Let’s get into it..

Quick Introductions to Stripe and Square

Before getting into the more nitty-gritty comparison, let’s start with some quick introductions to Square and Stripe.

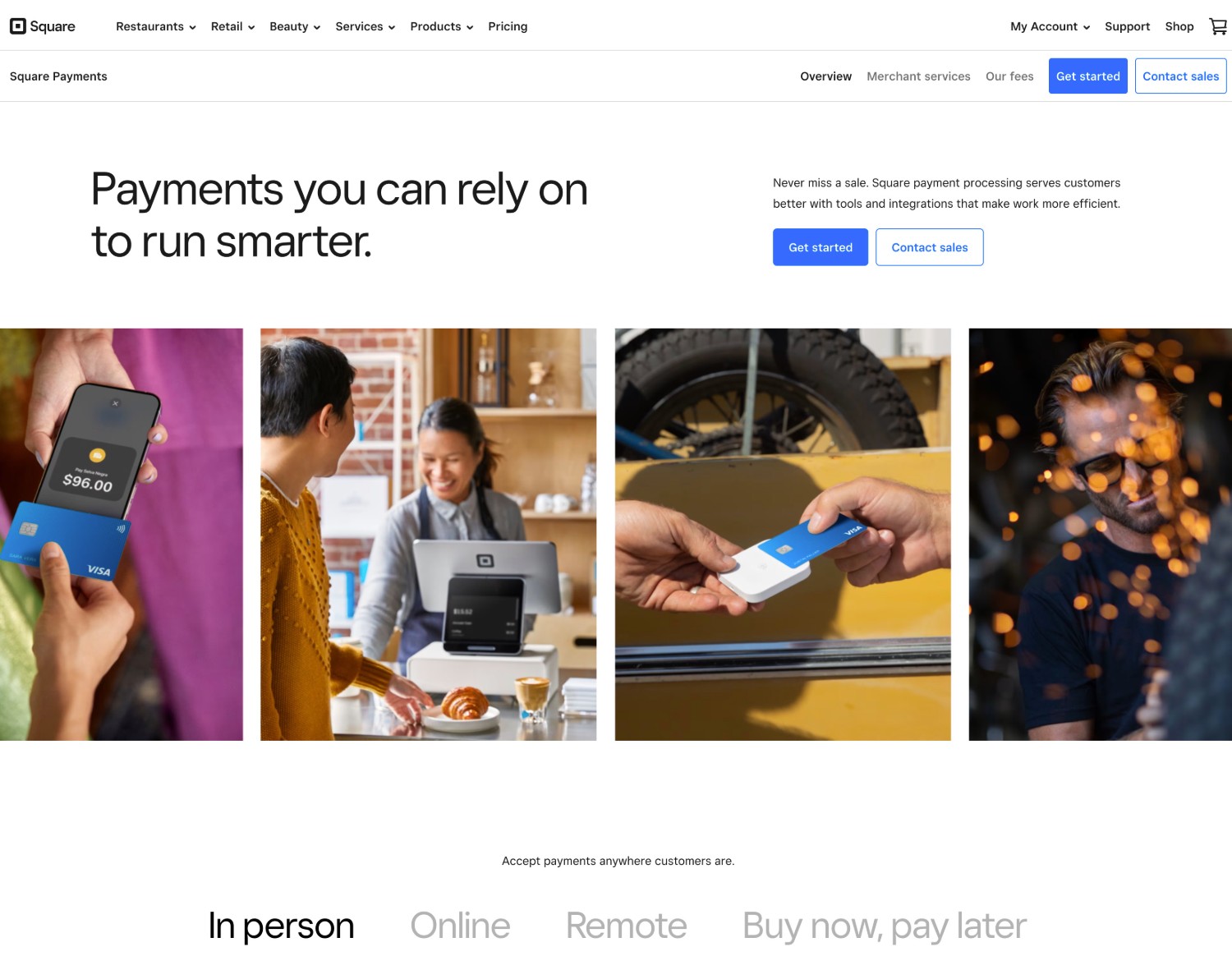

Square

Square got its start back in 2009. At that time, it was primarily known for its mobile card reader, which allowed people to easily accept in-person payments using their smartphones or tablets.

Since its 2009 founding, Square has grown to offer a robust set of online and in-person payment solutions. Beyond payments, it also offers other small business tools such as invoicing, appointment/booking management, and more.

Square also remains a big player in the in-person payments space and you’ll encounter Square’s point-of-sale systems at a ton of different small businesses. In fact, if you’re in one of Square’s markets, we can pretty much guarantee you’ve used a Square POS system at one of your favorite restaurants, cafes, etc.

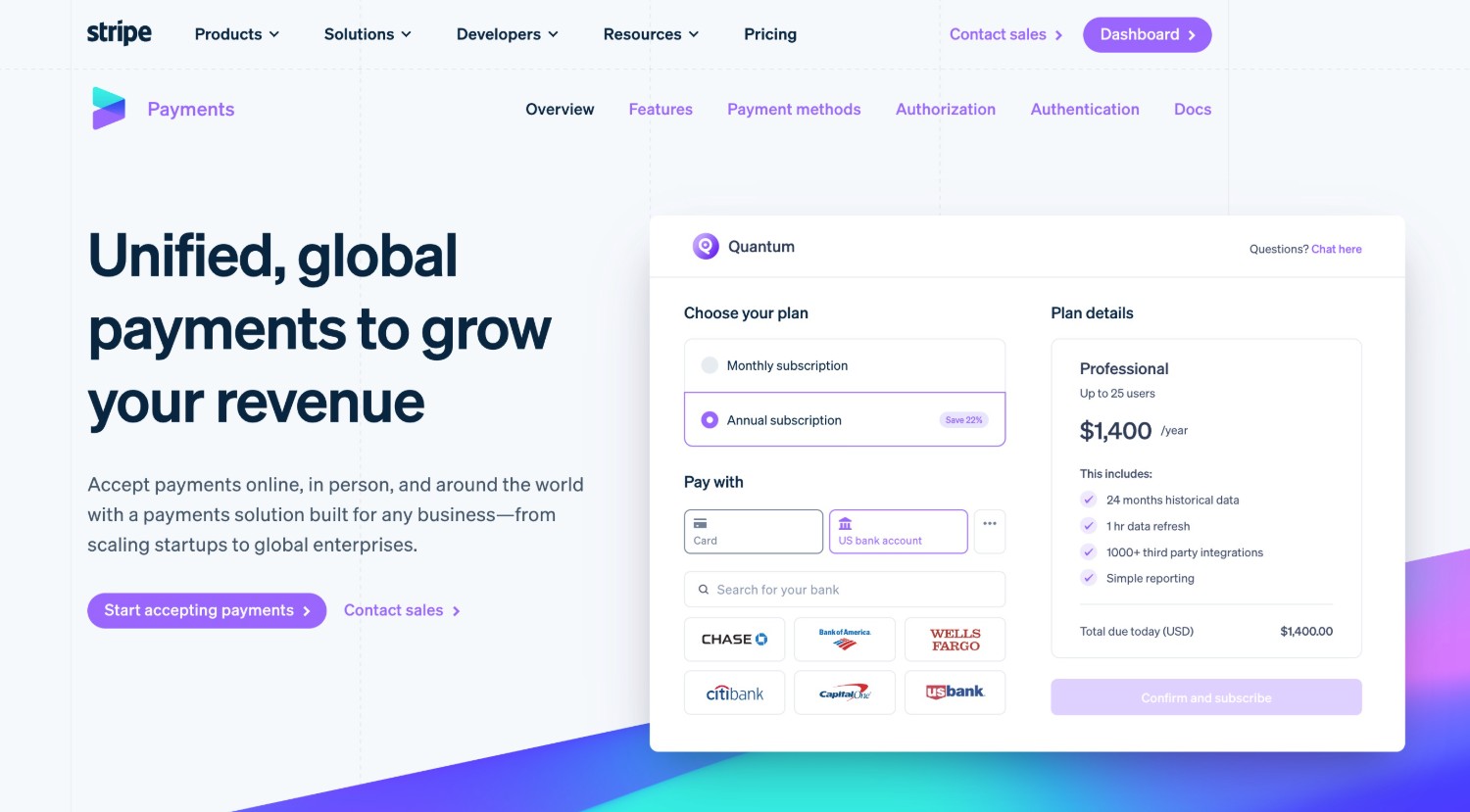

Stripe

Stripe was founded back in 2010, so around the same time as Square.

Whereas Square’s initial focus was on in-person payments via its card reader, Stripe got its start as an exclusively online payment processing solution.

With the launch of Stripe Terminal in January 2019, Stripe has also moved into the in-person payment space, though Stripe’s primary focus is still online payment solutions.

Whereas Square offers non-technical tools for small businesses, Stripe focuses a little bit more on creating an extensible platform for developers, with tons of APIs that developers can use to build custom solutions.

That definitely doesn’t mean you need to be a developer to use Stripe, though. For example, if you’re using WordPress, it’s super easy to set up Stripe payment forms using Gravity Forms (and the same for Square).

Notable Features

Now, let’s take a look at some of the most notable features that Square and Stripe offer.

Square

- Online payments – You can accept online payments via credit and debit cards, including Visa, MasterCard, American Express, Discover, JCB, and Union Pay.

- Physical hardware for in-person payments – Square offers portable readers that you can attach to your smartphone or tablet as well as more robust POS systems.

- Subscriptions – You can set up automatic recurring subscription payments and manage them in Square.

- Reporting tools – You can see detailed reports to get a better grasp of your business’s cash flow.

- Fraud protection tools – In addition to Square’s built-in protections, you can use Square Risk Manager to create your own rules to protect against fraud.

- Gravity Forms Square Add-On – Gravity Forms offers its own official add-on for Square that lets you use Square to accept payments via WordPress.

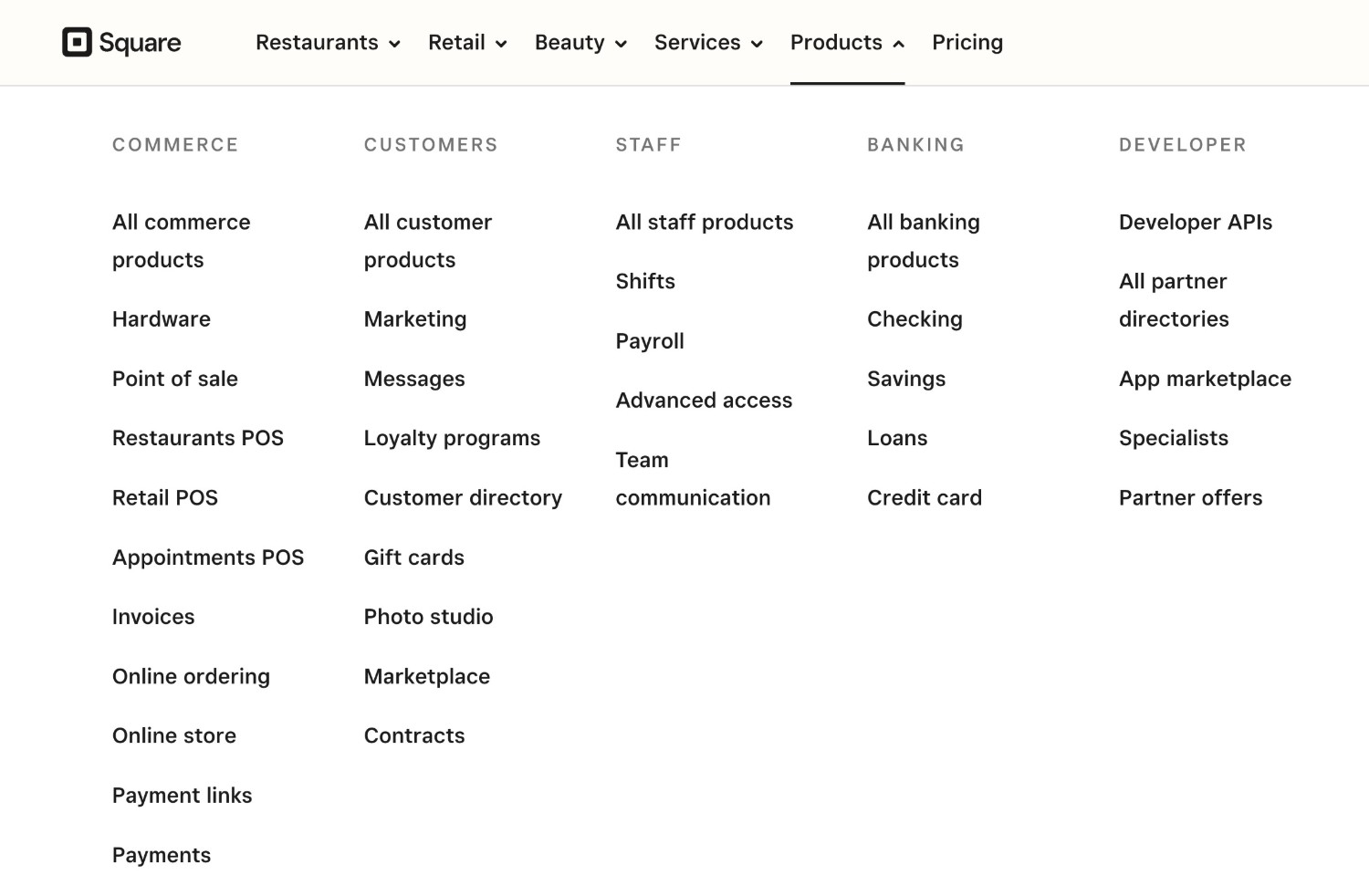

Beyond its payment processing solutions, Square also offers some other services for different types of businesses:

- Invoicing – Square supports full-service invoicing, including estimates, payment requests, and more.

- Loyalty programs – Square can help you implement a loyalty program to drive repeat sales for your business.

- Gift cards – You can create physical or digital gift cards for your business, which is something you won’t find in most payment processors.

- Appointment/scheduling management – For appointment-based businesses, Square includes tools to manage your business’s bookings.

To see everything that Square offers, check out Square’s website here.

In general, a lot of Square’s tools and services are focused on helping small businesses more effectively accept payments and manage their businesses without requiring technical knowledge.

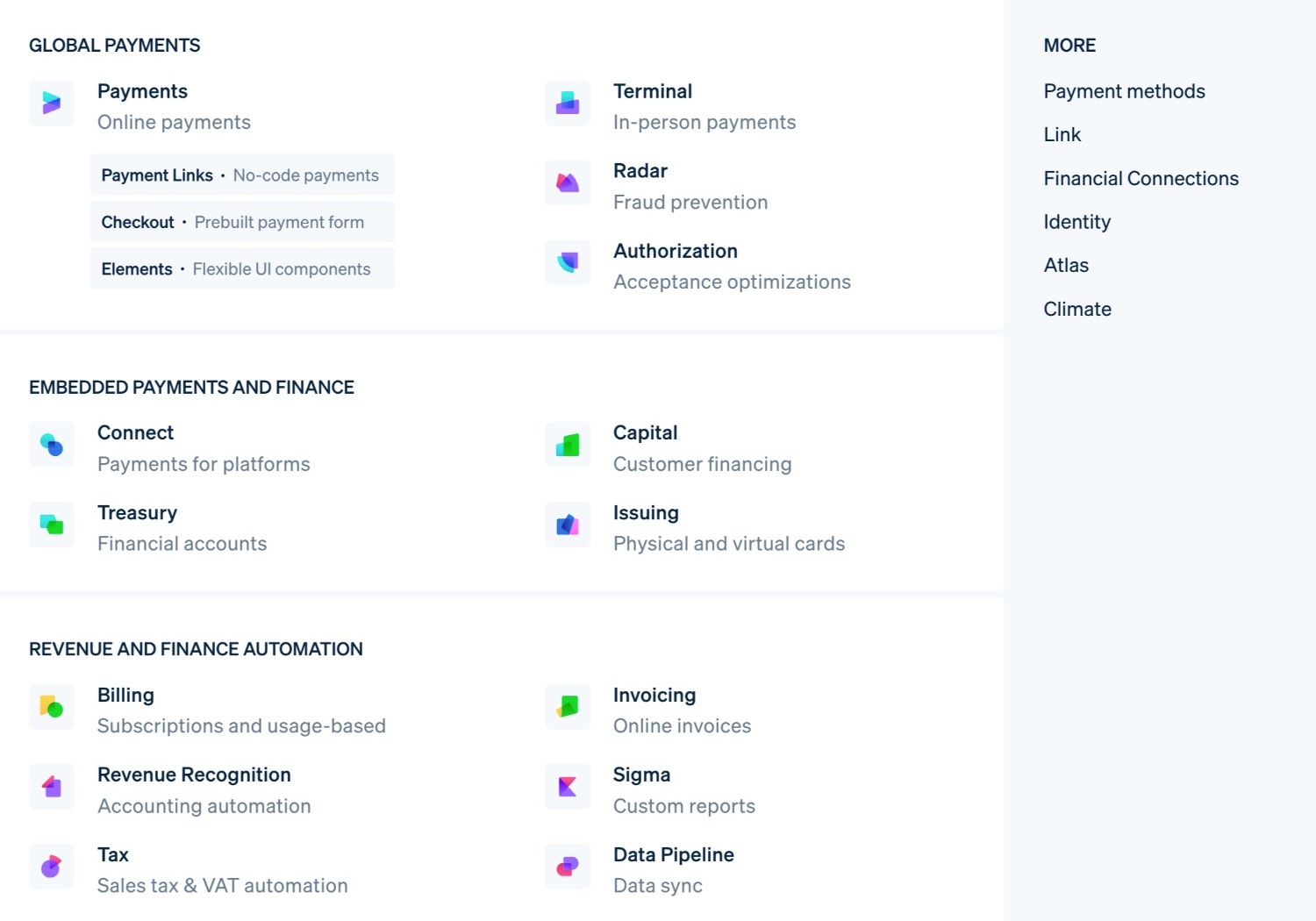

Stripe

- Online payments – Stripe’s primary focus is on helping businesses accept online payments.

- Support for a variety of payment methods – Stripe’s support for online payments goes far beyond just card payments, which is one of the most unique things about it. It supports lots of other wallets, including Apple Pay and Google Pay, bank transfer methods, and local payment options.

- In-person payments – Stripe can also handle in-person payments via its Terminal offering, though using Terminal is a little bit more complicated than Square’s in-person tools.

- Subscription payments – You can set up automatic recurring payments and manage them from Stripe.

- Reporting tools – You can see a bunch of reports about your business’s payments and subscriptions.

- Fraud protection tools – In addition to Stripe’s built-in features, you can use Stripe’s Radar offering to create your own fraud protection rules.

- Gravity Forms Stripe Add-On – The Gravity Forms team offers its own official add-on for Stripe that lets you use Stripe to accept payments via WordPress.

Beyond payment processing, Stripe also offers a number of other services and financial products. Here are some notable offerings:

- Invoicing – You can easily create and send invoices. Or, you can use Stripe’s Invoicing API to set up your own automated solutions.

- Atlas – A done-for-you service to help startups incorporate in Delaware.

- Treasury – A banking-as-a-service API that helps businesses embed financial services in their platforms.

- Tax – Stripe Tax can help with worldwide calculation and collection of sales tax and VAT.

As we mentioned in the previous sections, a lot of Stripe’s value-added offerings are more sophisticated technical tools that typically require custom development to integrate. This is different from Square’s approach, which is more focused on offering ready-to-use tools for small businesses.

Pricing, Rates, and Notable Fees

Next, let’s take a look at some of the relevant pricing, processing rates, and fees at Square and Stripe.

We can’t cover every single detail because the exact rates that you pay will depend on your specific situation. For example, details that can affect rates include your location, your currency (including whether you need currency conversion or not), the type of payment, etc.

Here’s a quick comparison of Stripe vs Square processing fees for accepting credit card payments in the USA and we’ll cover more detailed information below:

| Square | Stripe | |

| Online card payments | 2.9% + $0.30 per transaction | 2.9% + $0.30 per transaction |

| In-person card payments | 2.6% + $0.15 per transaction | 2.7% + $0.05 per transaction |

Note – We encourage you to check these rates yourself as they might have changed since the publishing of this article. Below, we’ve added direct links to pricing pages so that you can easily verify the current rates.

Square

Square charges the following rates for payments in the USA:

- Online card payments – 2.9% + $0.30 per transaction

- In person card payments – 2.6% + $0.15 per transaction

- Manual card entry card payments (i.e. you manually keying in a person’s credit card details) – 3.5% + $0.15

- ACH payments – 1%

- Square Payment Links – 3.3% + $0.30 per transaction

You can browse this page for more details on Square’s fees in the USA.

If you’re not in the USA, here are Square’s pricing pages for a few other regions:

For example, if you’re in the UK, Square charges 1.4% + 25p for standard UK cards or 2.5% + 25p for non-UK cards.

Square Chargeback Fees

Square is fairly unique in that it doesn’t charge a fee for chargebacks/disputed payments. Most payment processors, including Stripe, charge a nonrefundable fee in the $15-$20 range, but Square does not at the time of this writing.

Square Monthly Account Fees

There is no monthly account fee just to use Square for payment processing.

Square does have some special tools for restaurants, retailers, and appointment-based businesses. These plans start at $29 per month, but you do not need a paid plan just for payment processing.

Stripe

Stripe charges the following rates for payments in the USA:

- Online card payments – 2.9% + $0.30 per transaction

- Online wallet payments (Apple Pay, Google Pay, etc.) – 2.9% + $0.30 per transaction

- In person card payments – 2.7% + $0.05 per transaction

- Manual card entry card payments – 3.4% + $0.30 per transaction

- ACH payments – 0.8% ($5 cap)

- Stripe Link payments – 2.9% + $0.30 for domestic cards or 2.6% + $0.30 for Instant Bank Payments

You can see more about Stripe’s pricing here.

If you’re not in the USA, here are Stripe’s pricing pages for a few other regions:

For example, if you’re in the UK, Stripe charges 1.5% + 20p for standard UK cards or 2.5% + 20p for EU cards.

Stripe Chargeback Fees

Stripe charges a non-refundable $15 fee for all disputed payments, regardless of the outcome. This fee is pretty standard for the payment service provider industry, with Square being one of the notable services that doesn’t charge it.

Stripe Monthly Account Fees

Like Square, Stripe does not charge any monthly account fee for processing payments.

However, some of Stripe’s value-added services do have monthly fees. For example, if you want to use Stripe Payment Links or Checkout, you need to pay $10 per month to use a custom domain name.

Supported Countries and Currencies

Depending on the location of you and your customers, the countries and currencies that your payment processor supports could play another role in your decision.

If you’re in the USA, the UK, Canada, or Australia, this probably won’t factor into your decision. But if you’re located elsewhere, it could be something important to consider.

In general, Square focuses on a more narrow set of countries, while Stripe offers broader international support.

Square

At the time that we’re writing this post, Square supports physical payments and local currencies in eight countries:

- USA

- Canada

- UK

- Australia

- Japan

- Ireland

- France

- Spain

For in-person payments, you will only be able to accept payments within those countries.

For online card payments, Square accepts all major internationally-issued cards including Visa, MasterCard, AMEX, Discover, JCB, and UnionPay.

For online payments from international customers, Square will charge them in your currency (e.g. USD if you’re in the USA). If customers use a different currency, their local currency charge will be based on the exchange rate of their issuing bank.

You can read this help doc to see payment card support by country for Square.

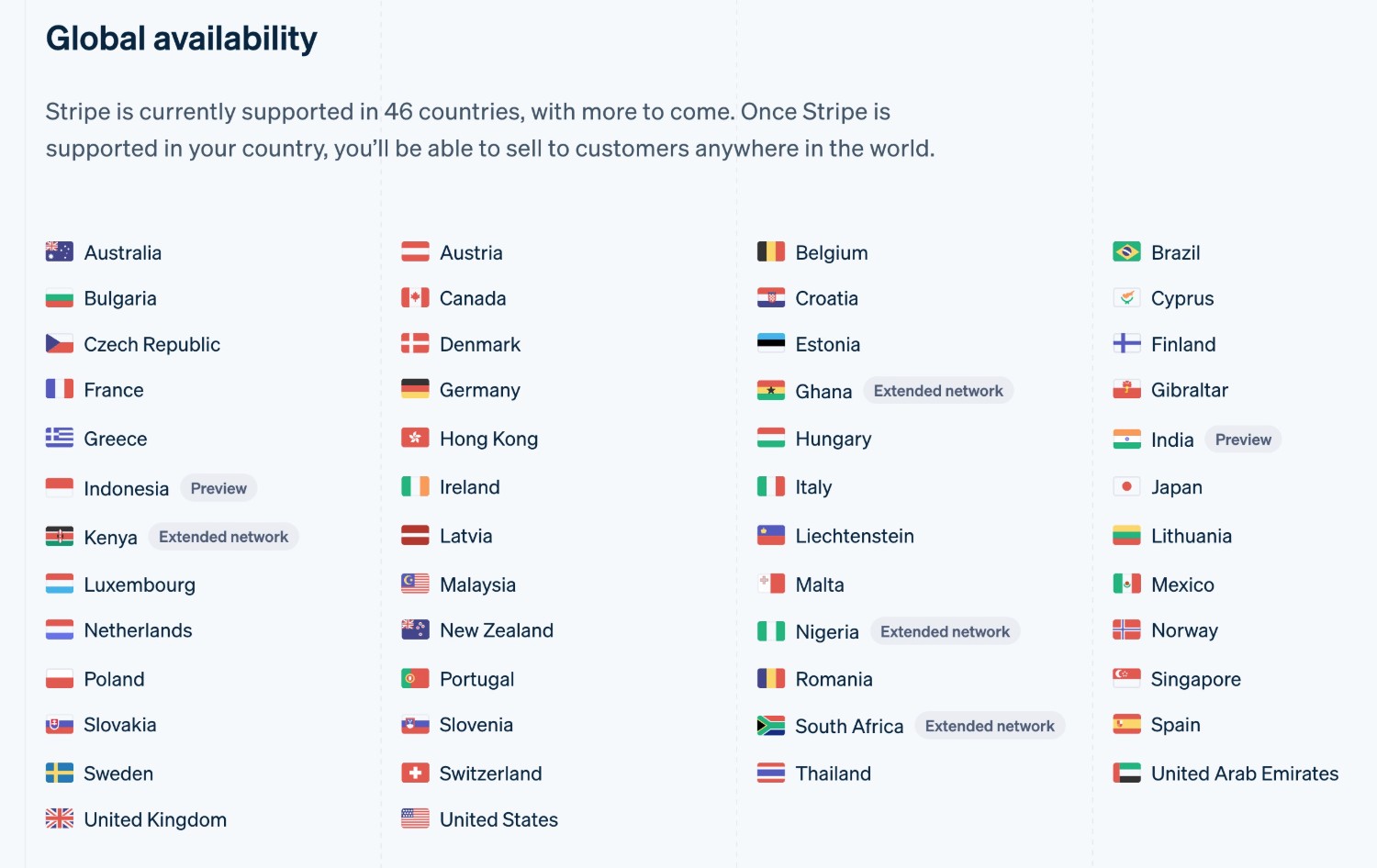

Stripe

At the time of this writing, Stripe has broader international availability than Square.

Currently, Stripe is available in 46 different countries. What’s more, you can charge customers in 135 different native currencies and then receive funds in your own currency (though Stripe might charge a currency exchange fee for the privilege of doing so, which is something to be aware of).

This allows you to present prices in your customers’ local currencies and avoid subjecting them to their bank’s conversion rates. If you want the ability to actually charge customers in their local currency (rather than your own local currency), this could be another advantage for Stripe.

As we mentioned earlier, Stripe also has broader support for local payment methods within these supported countries. For example, if you want to accept payments from Austrian customers, you can offer EPS payments.

Gravity Forms Add-Ons: Stripe vs Square

Gravity Forms offers official add-ons for both Square and Stripe, both of which are available on the Gravity Forms Pro, Elite, and Nonprofit licenses.

Thanks to that, it’s easy to use both Square and Stripe with Gravity Forms. However, there are a few differences between the options that are available with each add-on, which we’ll cover in this section.

Square Add-On

The Gravity Forms Square Add-On lets you use your WordPress forms to accept credit or debit card payments with Square.

Here are some of the most notable features of the Square Add-On:

- One-time payments – You can accept one-time payments based on the value of any pricing field in your form.

- Subscription payments – You can set up automatic recurring subscriptions, including choosing the billing cycle (e.g. daily, monthly, or yearly). You can have the subscriptions repeat indefinitely (unless manually canceled). Or, you can automatically stop them after a certain number of billing cycles, which is great for things like payment plans (e.g. three monthly payments of $99).

- Authorize and capture – You can authorize a person’s card upon form submission but wait to capture the money until later.

- Refund from WordPress – You can initiate payment refunds directly from your WordPress dashboard.

Stripe Add-On

One big difference between the Gravity Forms Stripe vs Square Add-Ons is that the Gravity Forms Stripe Add-On also gives you the ability to enable additional payment methods beyond credit and debit cards.

Here are some of the many other payment methods that you can access through the Gravity Forms Stripe Add-On, though the exact selection will depend on the currency of your form:

- Apple Pay

- Google Pay

- WeChat Pay

- ACH Direct (bank transfer payment in the USA)

- SEPA Direct Debit

- Bancontact

- EPS

- iDEAL

Beyond that, here are some of the other notable features of the Gravity Forms Stripe Add-On:

- One-time payments – Accept one-time payments using credit/debit cards or any of the payment gateways listed above, along with Stripe Link.

- Subscription payments – Create automatic recurring subscriptions on a customizable billing cycle. However, unlike the Square Add-On, the subscriptions will repeat until canceled and you cannot set a predetermined limit on the number of billing cycles.

- Customer self-management for subscriptions – Create a frontend area that lets subscribers manage their own subscriptions from your site. You can also cancel a person’s subscription from the WordPress dashboard.

- Free trials and one-time setup fees – Ooffer free trial periods for subscriptions and/or charge a one-time setup fee in addition to the subscription amount.

- Authorize and capture – Authorize a payment upon form submission but wait to capture the money until a later date.

- Refund from WordPress – Initiate payment refunds directly from your WordPress dashboard.

Gravity Forms also offers its own Stripe app that you can install to view form details inside the Stripe dashboard.

If you want to learn more, check out our ultimate guide to using Gravity Forms with Stripe.

In-Person Payments

Here at Gravity Forms, we’re always interested in helping you use Square and/or Stripe to accept online payments via your WordPress site.

However, you might also want the ability to accept in-person payments. In that case, you’ll probably want to use the same service for both online and in-person payments.

Overall, if in-person payments are an important part of your business, Square has the edge.

Let’s go through both services’ offerings…

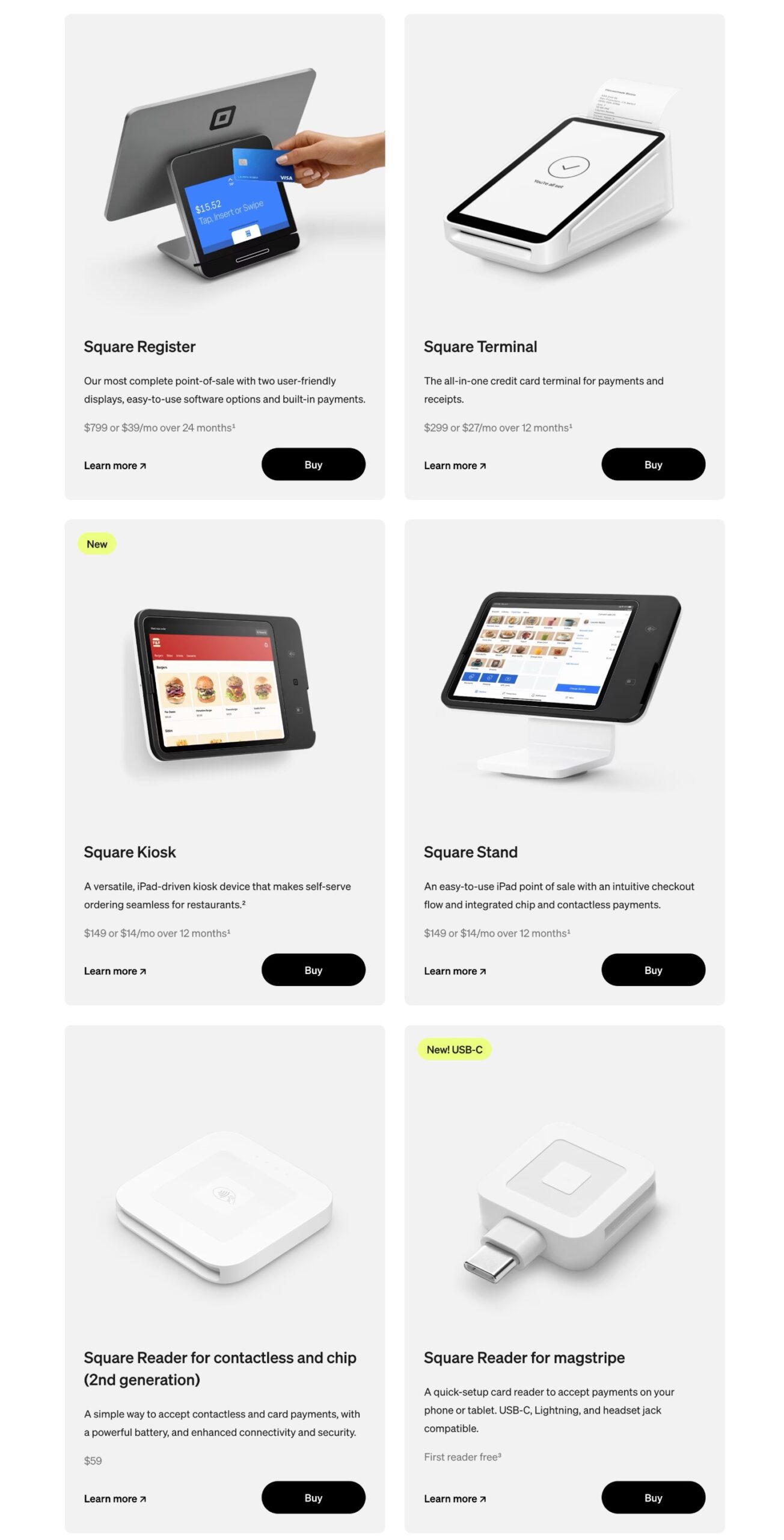

Square

Square got its start as a solution for in-person payments and it remains one of the leaders in the in-person space. In fact, given Square’s market share, there’s a pretty good chance that you’ve encountered Square at one of your local coffee shops or restaurants if you’re in one of the countries that Square supports.

Square offers multiple in-person payment solutions, including smartphone/tablet-based devices and standalone point-of-sale systems.

- Square Reader – Connects to your smartphone or tablet and lets you accept card payments.

- Square Terminal – An all-in-one solution that lets you accept card payments and contactless payments without needing a smartphone or tablet.

- Square Stand – Add your own iPad and you’ll instantly have a full POS solution.

- Square Register – A multi-display solution that has one big screen for your customers and a smaller screen for you/your staff.

All of these hardware offerings are easy to use and don’t require any special technical knowledge.

There are also tons of Square-compatible accessories that you can use to enhance your system, including receipt printers, barcode scanners, cash drawers, scales, etc.

Stripe

While Stripe focuses primarily on online payments, it does now support in-person payments as well via Stripe Terminal.

Stripe’s hardware offerings for in-person payments are not as robust as Square’s, but Stripe does offer a card reader for smartphones or tablets (Stripe Reader M2) as well as a standalone Android-based smart reader (Stripe Reader S700).

However, it’s important to note that Stripe’s hardware is not entirely “plug and play” like Square’s hardware is. You’ll need to code your own solution using the Terminal API or use existing POS software that integrates with Stripe Terminal.

If you’d prefer a less technical setup, this might be another reason to consider Square if you need to accept in-person payments.

Final Thoughts on Stripe vs Square

Overall, both Square and Stripe are excellent payment processors, so you will not make a wrong decision when choosing between the two.

Instead, your choice should really come down to what you value the most.

Stripe Summary

For webmasters, two of Stripe’s big advantages are its global coverage and the broad array of payment methods that it supports beyond credit and debit cards. You can also let people pay with wallets like Apple Pay and various bank transfer methods, including ACH, SEPA Direct Debit, and more.

It’s also important to note that, if you’re creating payment forms with Gravity Forms, the Gravity Forms Square Add-On currently only supports credit and debit card payments, so you might want to use the Gravity Forms Stripe Add-On if accepting those other payment methods in Gravity Forms is essential to your use case.

Square Summary

Of course, Square also has its own advantages.

One big one is Square’s robust support for in-person payments via its various hardware, including full point-of-sale systems. While Stripe did launch its own in-person payment system in 2019 via Stripe Terminal, in-person payments is still an area where Square really excels in comparison to its competition.

Therefore, if you want to accept in-person payments along with payments via your website, you might like Square because you can do everything from one system.

Square also just generally does a great job of offering helpful and non-technical tools for businesses, along with other perks like not charging a nonrefundable fee for chargebacks.

Final Thoughts

Beyond payments, Square and Stripe also just generally have slightly different approaches to their offerings.

Square offers ready-to-use tools for small businesses that don’t require any technical knowledge, while Stripe offers a lot of flexible APIs and sophisticated offerings that let businesses build their own technical solutions.

This difference probably doesn’t matter if you just want to accept payments with Gravity Forms, but it might factor into your decision if you want to go beyond that.

Because neither service charges a monthly account fee, you can sign up for both and explore their offerings hands-on before making your final decision.

Regardless of whether you choose Square or Stripe, you’ll be able to create WordPress payment forms using Gravity Forms.

Purchase a Gravity Forms Pro, Elite or Nonprofit license today to get started with Square or Stripe on WordPress.

If you want to keep up-to-date with what’s happening on the blog sign up for the Gravity Forms newsletter!